If you haven’t already noticed, it was a Landlord’s market in 2021 and this trend continued strong into 2022.

Tenants all over Singapore struggle to find rental units at the rents they were used to paying.

But prices will not weaken in a market where we often have more than 5 groups bidding for a single unit, each desperate to secure a unit, which they know can be snapped up in a matter of days or hours from the very first viewing.

Landlords all over Singapore cannot be happier.

All unit types from HDB flats to landed property have enjoyed the same surge in demand, amid a crazy market, coping with construction delays, and supply-chain material and labour shortages.

Likewise, resale prices have gone off the roof as well. Buyers on the ground are shocked at the dismal number of resale units available and the sky high price sellers are asking for.

So the dilemma for landlords lies in whether to hold on to their investment units that can command a fabulous rental yield or cash out in the lucrative resale market. Well it would very much depend on the property.

If you’re holding onto a unit in an older development with limited growth opportunity, then now would be perfect time to cash out.

Yes, a higher rent may be attractive, but if you’re sitting on a leasehold property which will likely stagnate rather than appreciate, then it would be a pity not to make use of the opportunity to get a good profit.

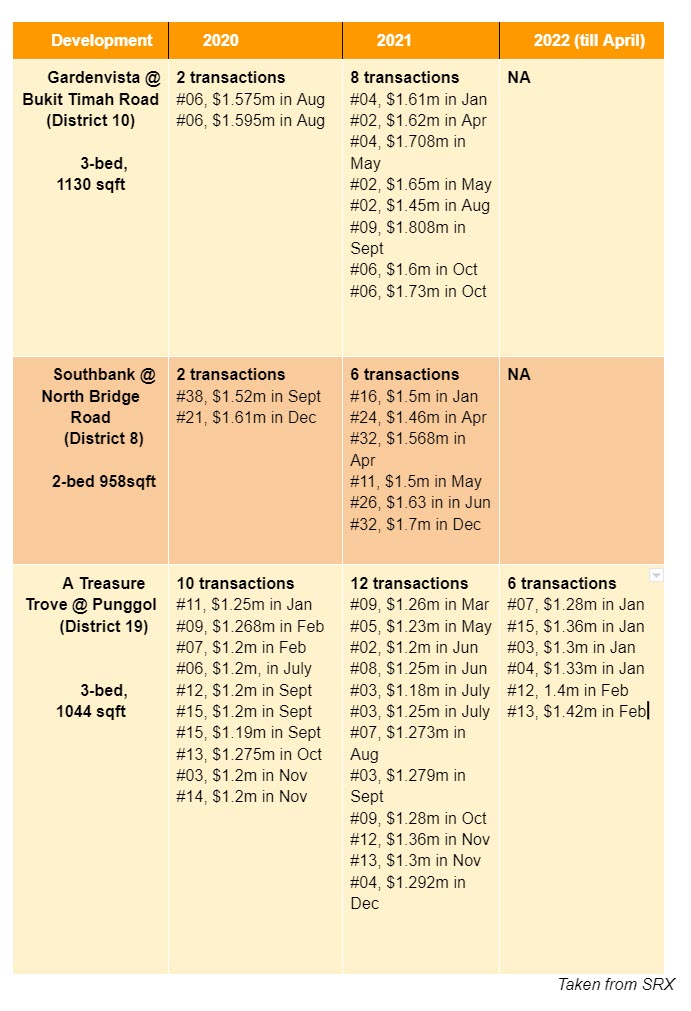

Here are how some 99-year leasehold properties are doing from 2020 till now.

Sale prices for all these condominiums in 3 different areas have seen significant price growth from 2020 to 2021, and even more

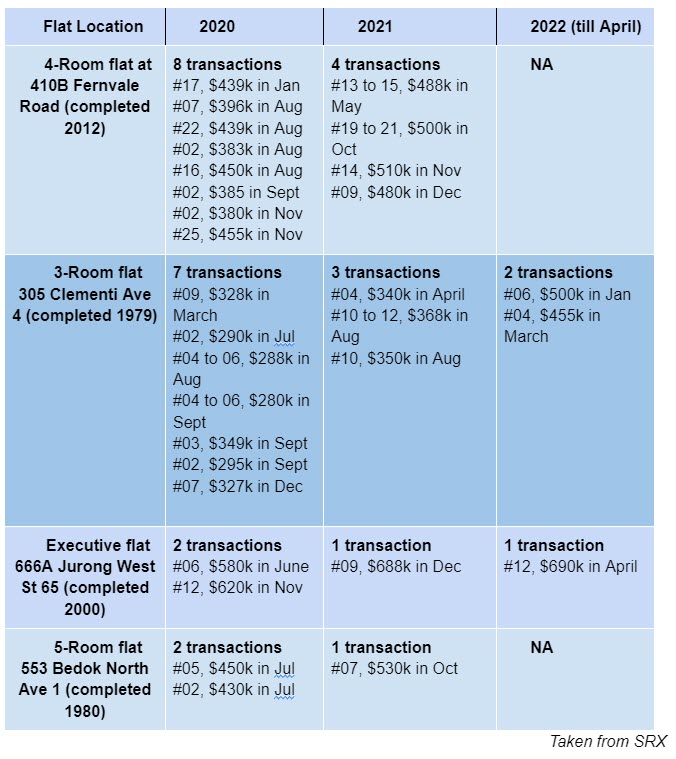

On the other spectrum, we also have individuals who own both private and public properties.

Personally I feel that HDB owners who have moved on to purchase and reside in a private property but still holding onto and renting out their HDB flats for rental income should really consider selling during this period where they can get the most out of their flat.

The premium fetch during this period is reminiscent of the last peak in 2012/2013.

If you’re at the stage where you are looking to retire and more risk averse, then I can’t see a better time to cash out.

Depending on the amount of profit, you can choose to reinvest part of the sum or simply to enjoy the fruits of your investment.

A common concern I hear from clients, “I’ve nothing better to buy and with the Additional Buyer’s Stamp Duty, I would be better off just collecting rent.”

My answer: we take a long term approach for property investment. So there is always something better to buy.

While paying the ABSD may be painful, the gains are there in the long run, as long as you buy a good property with better growth than an older leasehold property with limited potential.

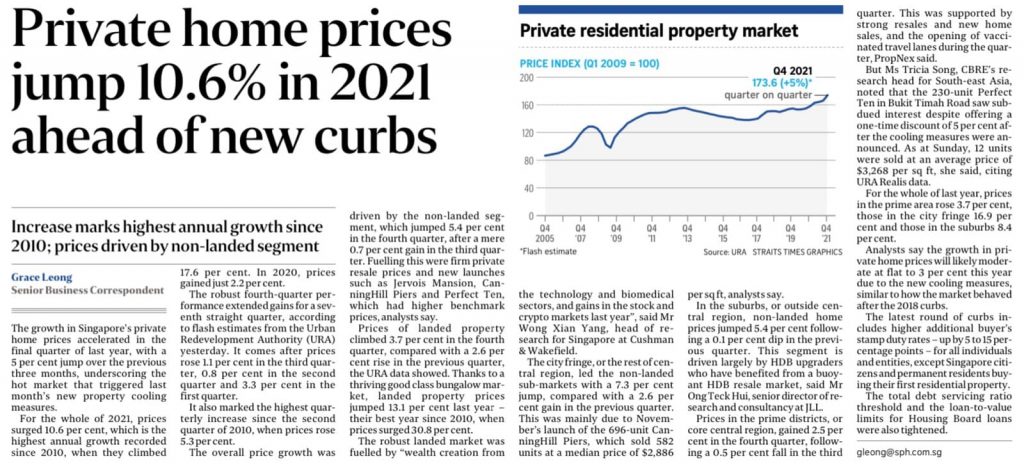

Just last year, private home prices increased by a whopping 10.6%.

Yes I’m sure we are not expecting such spectacular growth every year. But even with a more modest growth rate, most home-owners will be able to make a profit after factoring ABSD in 10 to 15 years.

In simpler terms, would you rather hold onto a stock that provides great dividend or cash out when prices head north during a bull run?

2021 was a good year to sell, and the next two years in my opinion, will continue to look kindly on sellers/ landlords.

Yes, we see more land sales being released, more HDB launches and developers catching up on construction delays caused by the COVID years, but these will take time, and until supply eventually catches up, it’ll continue to be a sellers’/ landlords’ market.

As an agent who has done my fair share of rental transactions, I am highly aware of the various issues and problems of getting a good tenant and navigating the sometimes turbulent relationship.

It is not always a shake legs and collect money scenario.

If you been planning to exit out from the challenges of being a landlord, this year might be the best time to do so.

Have questions? Let me know via WhatsApp. All our discussions are no-obligation.

[…] shared about how some older properties were appreciating in value in the recent […]